Maximize Your Profits: How to Monetize Virtual Funds in Crypto Trading

The rise of cryptocurrency has transformed the financial landscape, presenting various opportunities for individuals and businesses to monetize virtual funds. In this comprehensive guide, we will explore how you can effectively engage in crypto trading, strategies to maximize your investment, and practical tips to enhance your trading outcomes.

What Are Virtual Funds?

Virtual funds refer to digital currencies and assets that exist in electronic form. Unlike traditional money, which is issued and regulated by governments, virtual funds are decentralized and backed by blockchain technology. The most prominent examples of virtual funds include:

- Bitcoin (BTC): The first and most widely recognized cryptocurrency.

- Ethereum (ETH): Known for its smart contract functionality.

- Ripple (XRP): Aimed at facilitating cross-border transactions.

- Litecoin (LTC): Often described as the silver to Bitcoin’s gold.

Understanding Crypto Trading

Crypto trading involves buying and selling cryptocurrencies to make a profit. Monetizing virtual funds through trading requires a deep understanding of market dynamics, trading strategies, and risk management. Below are key concepts to grasp.

Types of Crypto Trading

There are several methods to trade cryptocurrencies, each with its benefits and risks:

- Day Trading: Buying and selling assets within the same trading day to capitalize on short-term price movements.

- Swing Trading: Holding positions for a few days or weeks to benefit from expected price moves.

- Scalping: Making dozens of trades each day to “scalp” a small profit from each transaction.

- Long-term Investing: Buying and holding cryptocurrencies for an extended period to profit from long-term trends.

Choosing the Right Exchange

To successfully monetize virtual funds, selecting the right cryptocurrency exchange is crucial. Here are some factors to consider:

- Security: Ensure the exchange has robust security measures in place to protect your funds.

- Fees: Compare transaction fees among different exchanges; even small differences can add up significantly.

- User Experience: Opt for platforms that offer an intuitive interface suitable for your trading skills.

- Support for Various Cryptocurrencies: Choose an exchange that supports a wide range of coins to diversify your portfolio.

Strategies to Monetize Virtual Funds

Once you’ve chosen an exchange, it's essential to adopt effective strategies to capitalize on your investments:

1. Conduct Thorough Research

Knowledge is power in the world of crypto trading. Stay informed about market trends, news, and technological advancements. Utilize resources such as:

- Crypto news websites

- Industry blogs

- Social media platforms

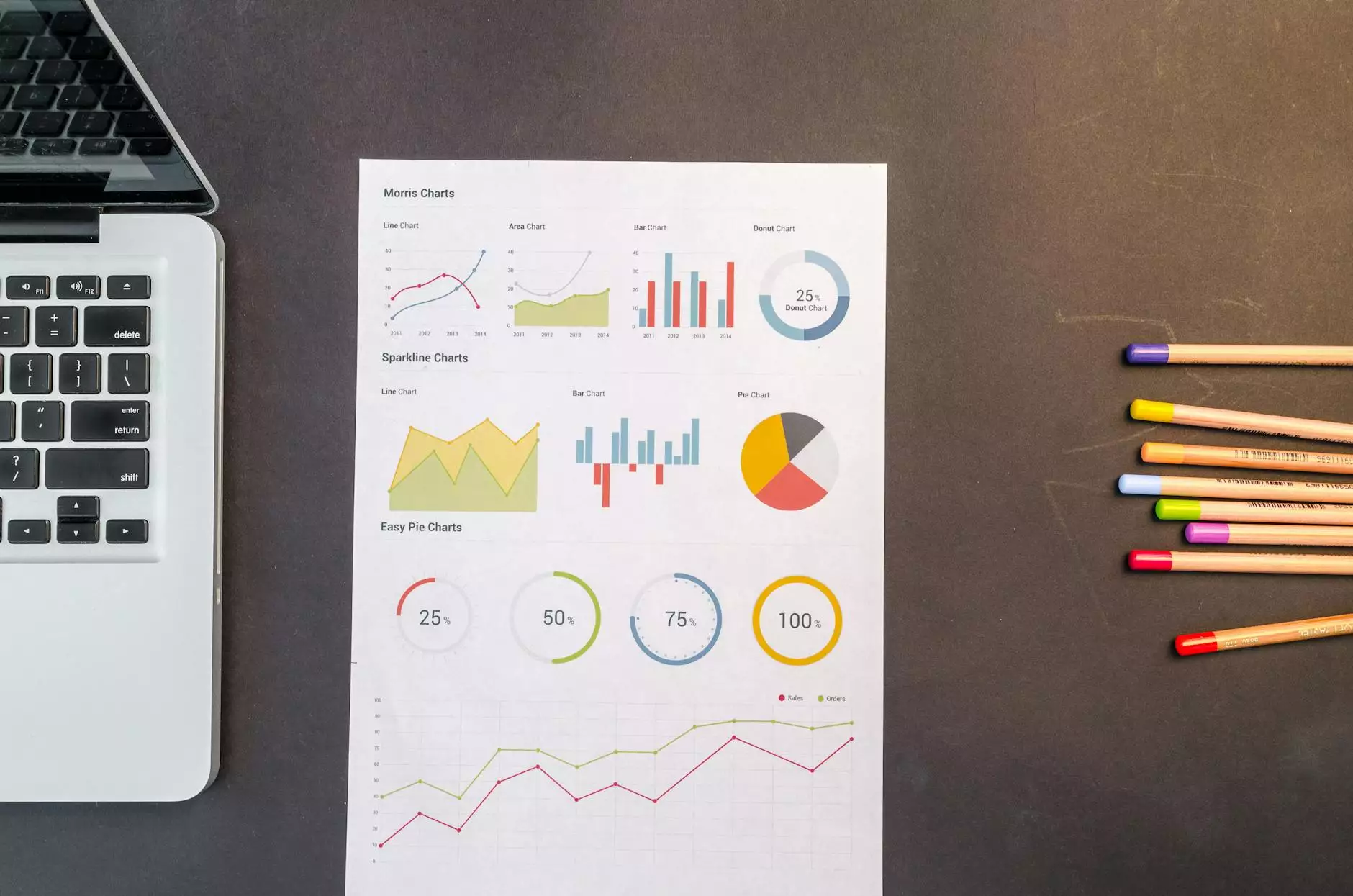

- Analytics tools and charts

2. Set Clear Goals

Define your trading objectives—whether they are short-term gains or long-term investments. Having clear goals helps maintain focus and discipline, preventing impulsive decisions driven by market volatility.

3. Diversify Your Investments

Don’t put all your eggs in one basket. By diversifying your portfolio across different cryptocurrencies, you can mitigate risks associated with a single asset’s performance. Consider allocating your funds strategically across various categories, such as:

- Established currencies: Such as Bitcoin and Ethereum

- Emerging altcoins: Promising newer projects

- Stablecoins: For minimizing volatility in your portfolio

4. Implement Risk Management Techniques

Effective risk management is vital for successful trading. Here are some techniques to consider:

- Set Stop-Loss Orders: Automatically sell your assets at a predetermined price to limit losses.

- Use Position Sizing: Only invest a small percentage of your total capital into a single trade.

- Keep Emotions in Check: Always have a trading plan and stick to it, regardless of market emotions.

Staying Compliant and Understanding Regulations

In the rapidly evolving world of cryptocurrency, staying compliant with regulations is paramount. Various countries have different laws governing crypto trading. Here are some key points to consider:

- Know Your Customer (KYC) policies: Most exchanges require you to verify your identity before trading.

- Tax implications: Understand your jurisdiction’s tax obligations regarding crypto transactions.

- Regulatory changes: Stay updated on the evolving landscape of cryptocurrency regulations as they can materially affect how you trade.

Leveraging Technology for Crypto Trading

Technology can significantly enhance your trading capabilities. Here are some tools and platforms to consider:

- Trading Bots: Automated trading algorithms can execute trades on your behalf, based on predetermined strategies.

- Technical Analysis Tools: Use charts and indicators to analyze market trends and make informed decisions.

- Portfolio Trackers: Keep track of your investments and performance in real-time to assess your strategy's effectiveness.

Common Mistakes to Avoid When Monetizing Virtual Funds

To maximize your success in crypto trading, avoid these common pitfalls:

- Overtrading: Making excessive trades can quickly erode profits.

- Neglecting Research: Failing to research can lead to poor investment choices.

- FOMO (Fear of Missing Out): Emotional trading can result in hasty decisions that don’t align with your strategy.

Conclusion

In conclusion, the potential to monetize virtual funds in the realm of cryptocurrency trading is vast and ever-expanding. By focusing on knowledge acquisition, strategic planning, risk management, and technological enhancements, you can pave the way toward successful crypto trading. Embrace the journey, remain disciplined, and continually adapt to the fluid market environment to ensure lasting success.

Explore more about our insights and resources at monetizevirtualfunds.software to elevate your trading strategies.